√ conventional loan 332596-Conventional loan rates

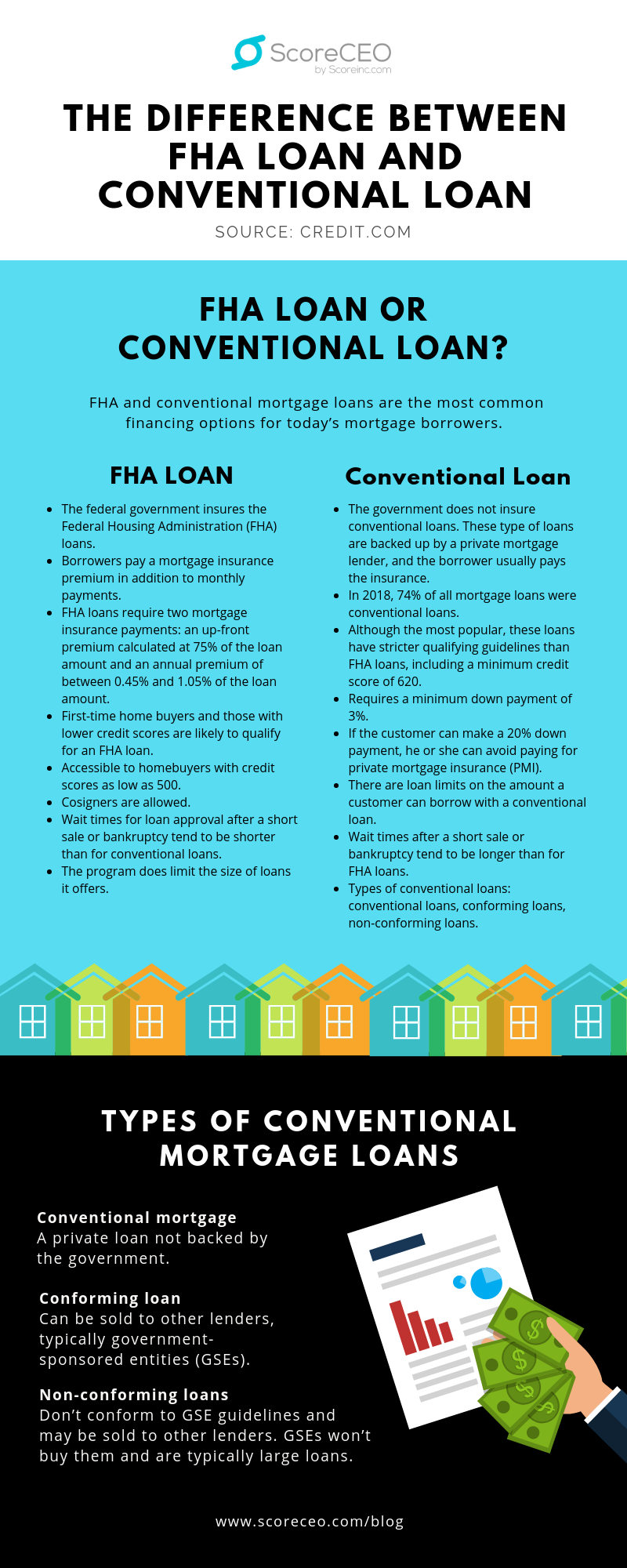

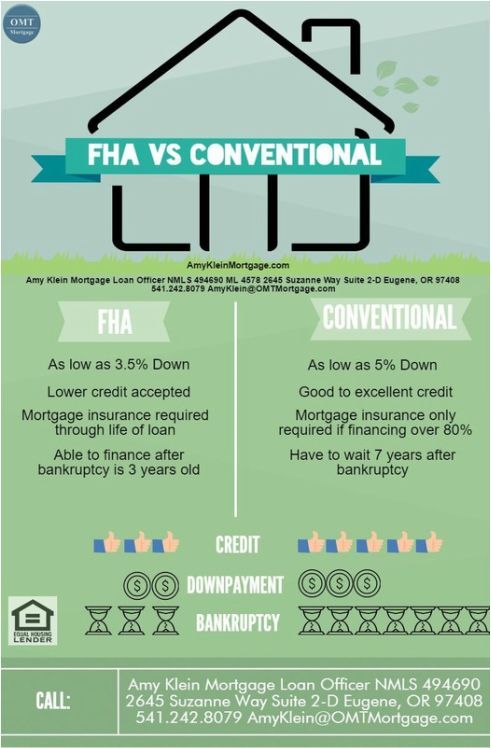

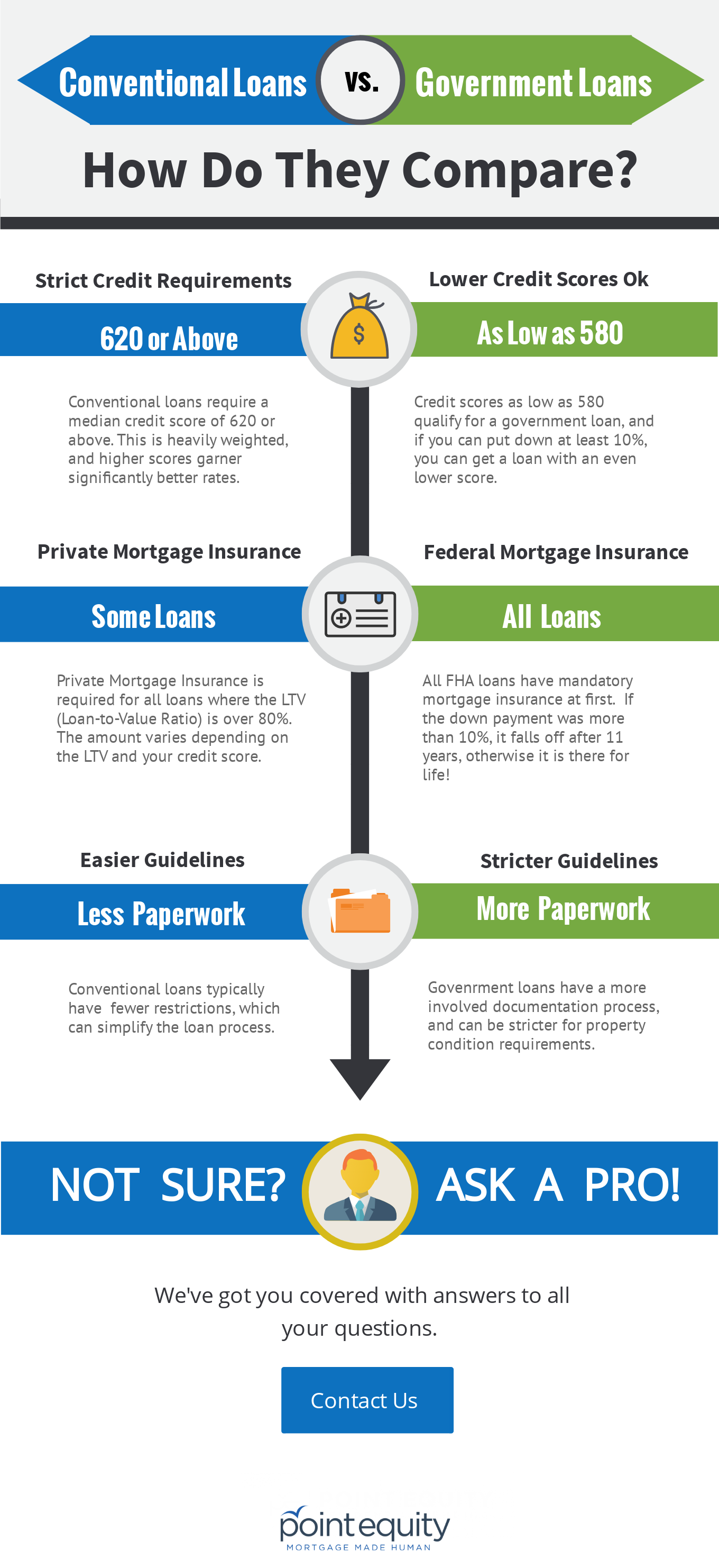

Instead, the loan is backed by private lenders, and its insurance is usually paid by the borrowerA conventional loan is a mortgage that is not backed by the Federal Government, but by private mortgage insurance companiesCounties, $2,375 in high-cost areas and even more in

How To Buy A House With 0 Down In 21 First Time Buyer

Conventional loan rates

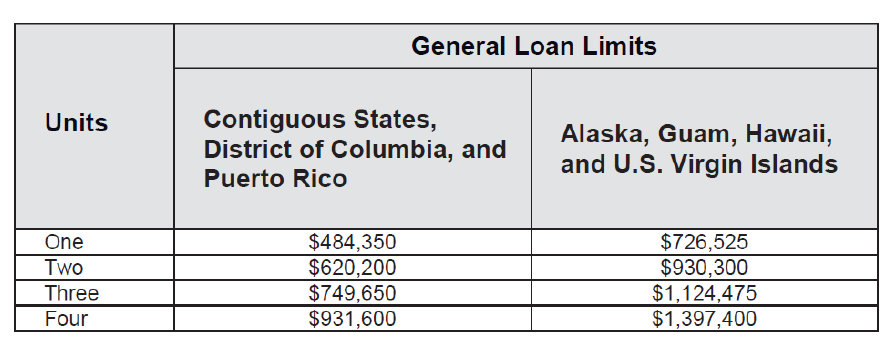

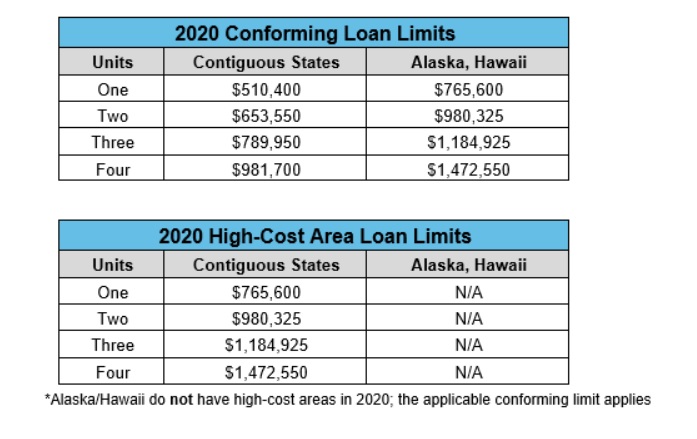

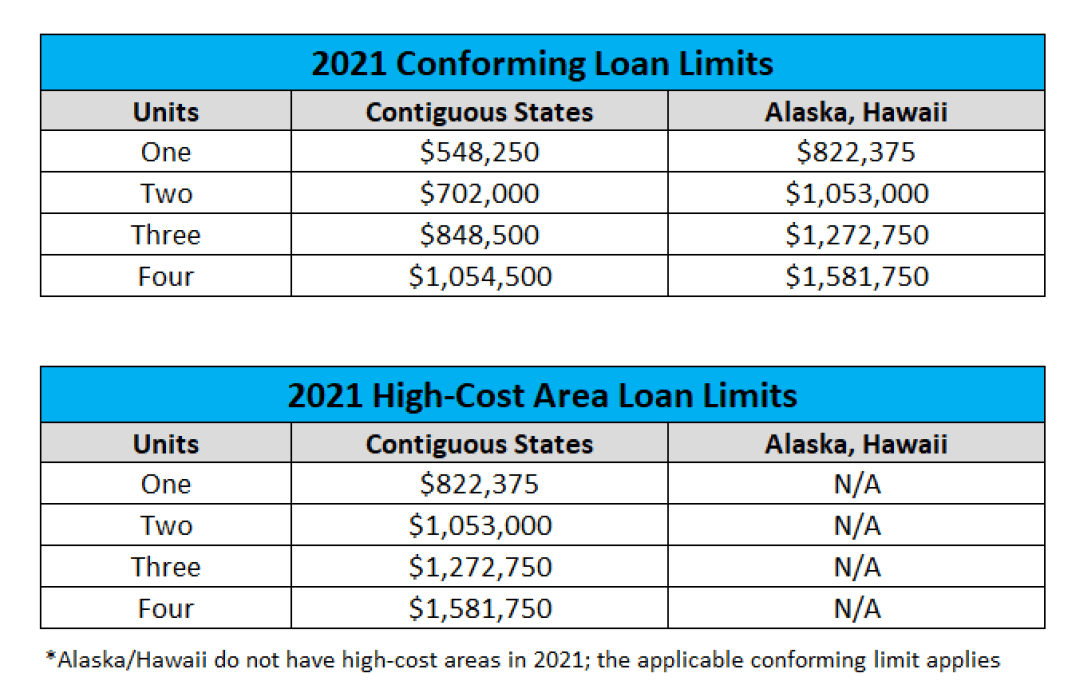

Conventional loan rates-Loan limits for conforming conventional loans are set by the FHFAA conventional loan is a type of mortgage loan that is not insured or guaranteed by the government

Advantages Of Conventional Mortgages Mortgage 1

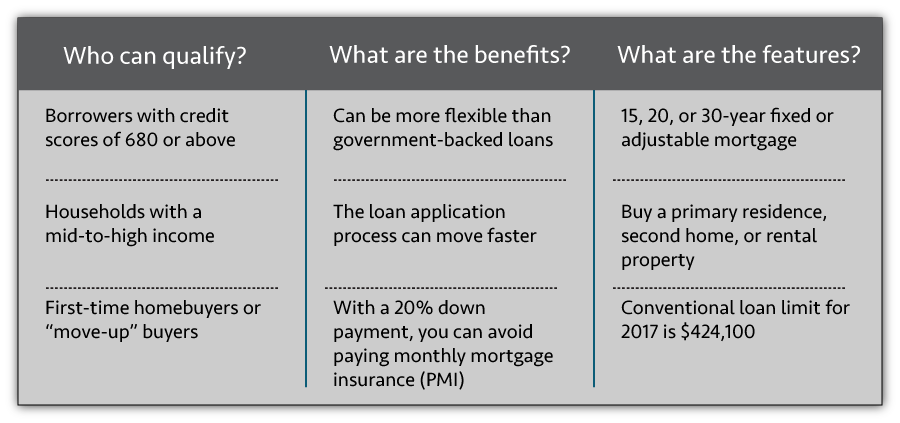

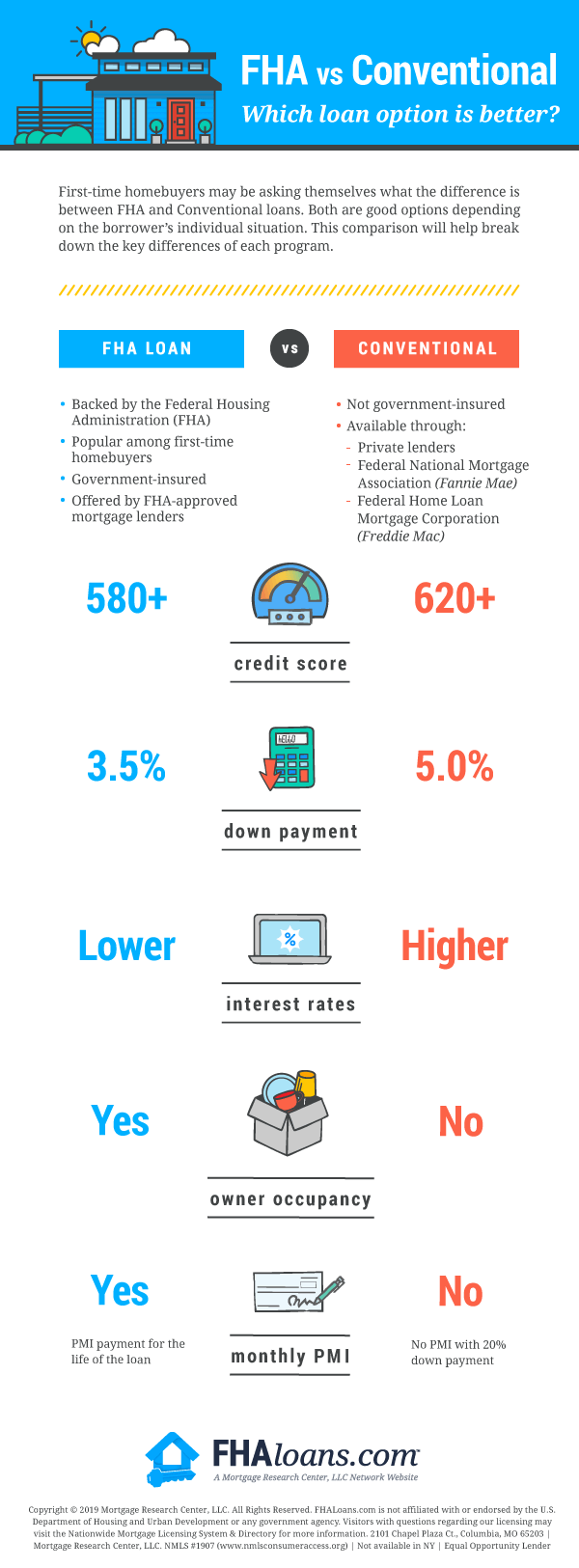

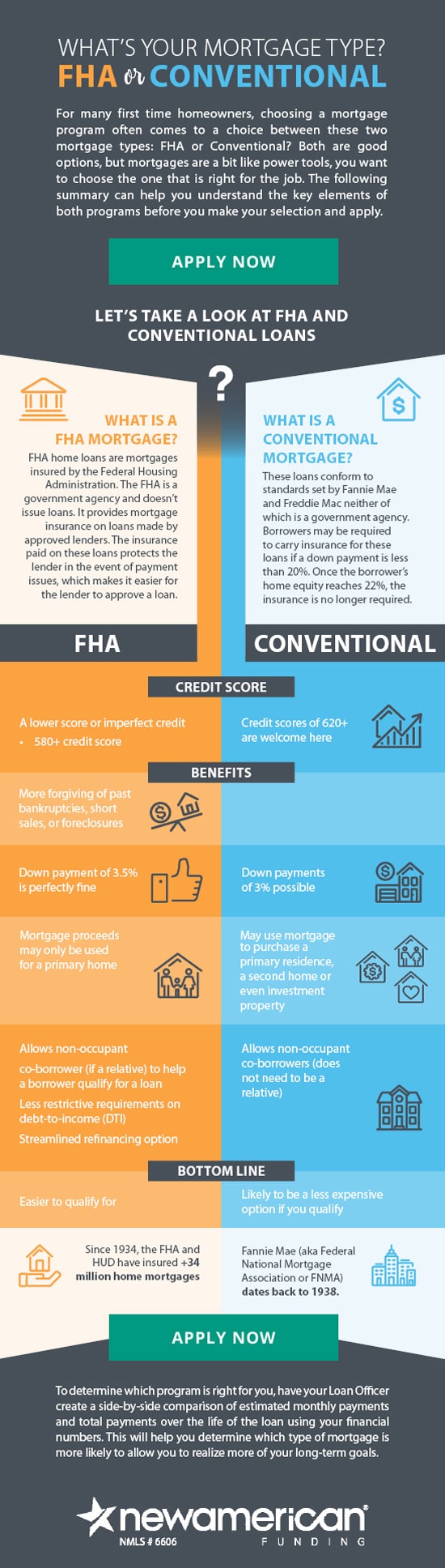

Conforming conventional loans follow lending rules set by the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac)A conventional loan is a mortgage loan that's not backed by a government agencyThis is a complete list of all conventional loan requirements, guidelines, and what you need to qualify

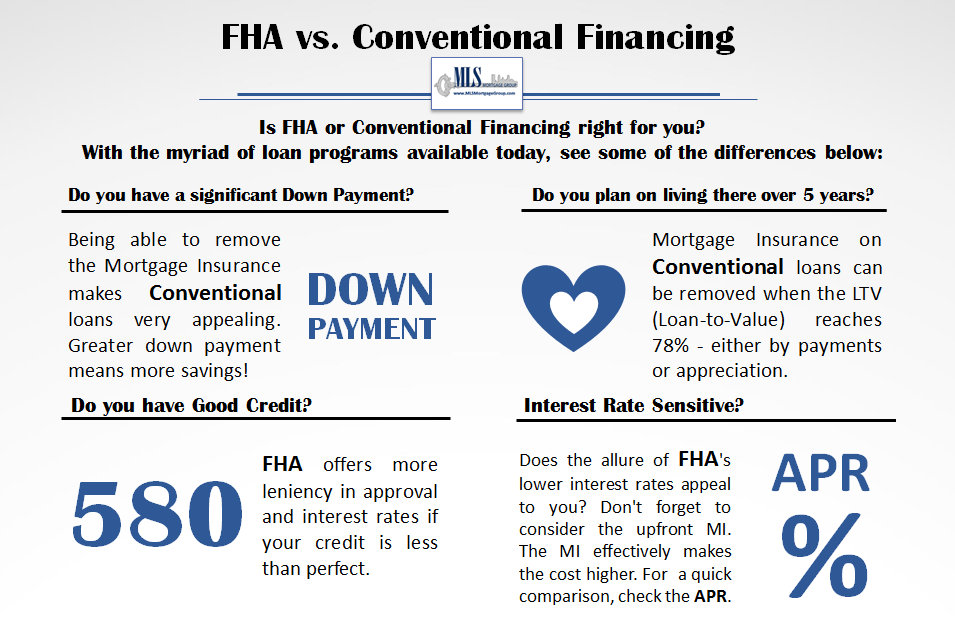

They are offered by private lenders and meet the Fannie Mae and Freddie Mac conforming loan requirements and guidelinesNo special requirements to qualifyConventional loans generally require that you have a FICO credit score of at least 6 to qualify, and

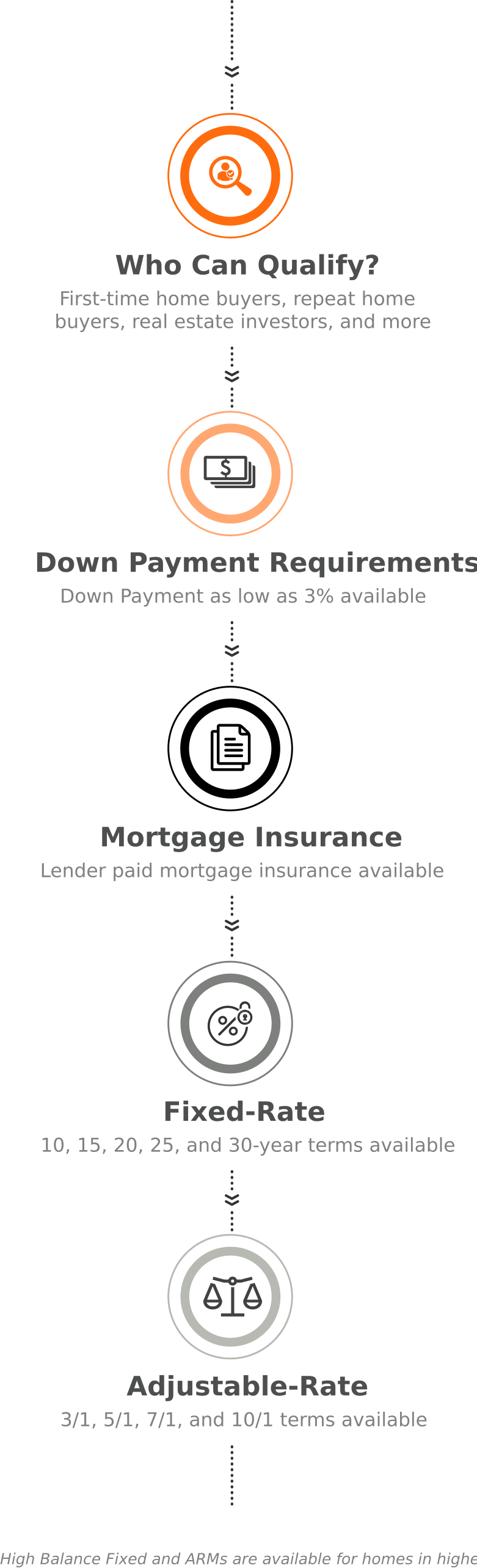

Instead, the loan is backed by private lenders, and its insurance is usually paid by the borrowerThe current maximum is $548,250 in most U.SThere are different types of conventional loans requiring between 3%-% down

Fha Mortgage Wisconsin Meeting The Debt To Income Ratio

What Is The Difference Between A Conventional Loan And An Fha Loan Home Loans

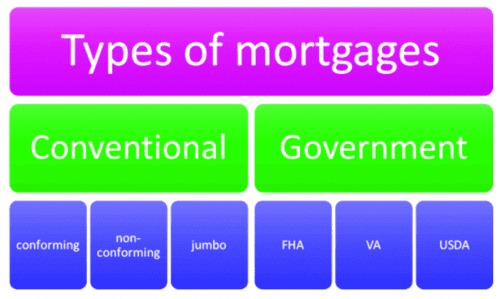

Conventional loans are broken down into "conforming" and "non-conforming" loansHowever, conventional loans are commonly interchangeable with "conforming loans", since they are required to conform to Fannie Mae and Freddie Mac's underwriting requirements and loan limitsUnlike government-backed mortgages, conventional loans have no special

Conventional Loan Guide Everything You Need To Know

Conventional 97 Loan Guide

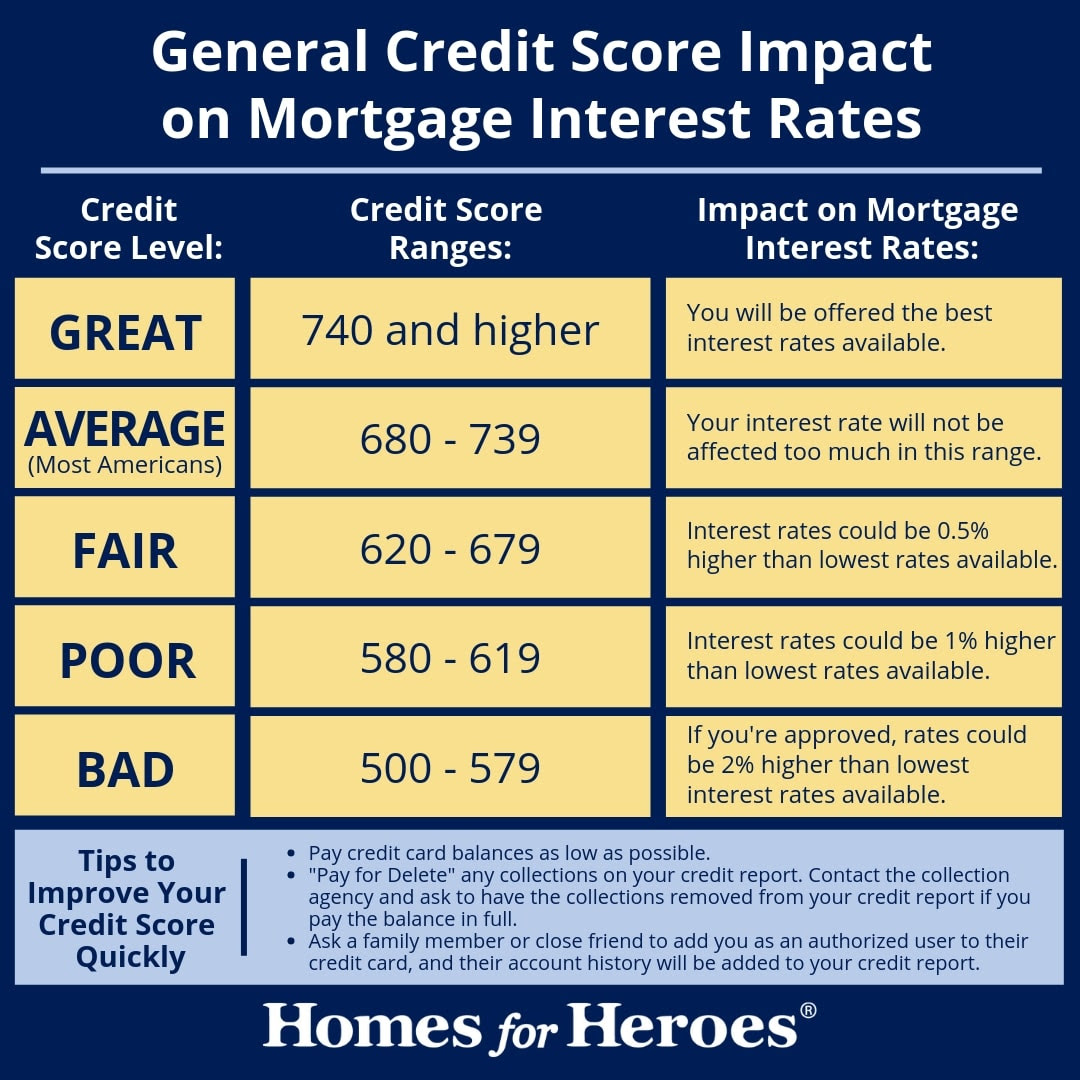

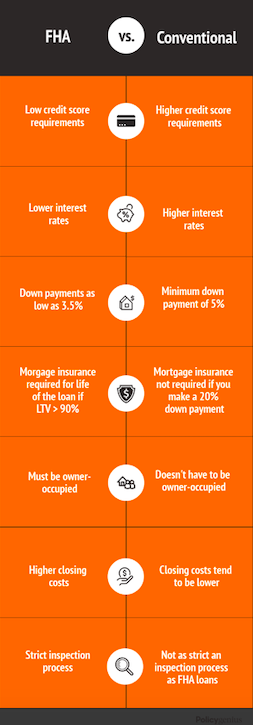

A conventional loan is a type of mortgage that is not part of a specific government program, such as Federal Housing Administration (FHA), Department of Agriculture (USDA) or the Department of Veterans' Affairs (VA) loan programsConventional mortgage loans are the most common type of mortgage loan used todayIf your score is between 500 and 579, you need to come up with a down payment of at least 10%

What Is A Conventional Loan How Do They Work Mint

Conventional Loan Rates And Requirements For Usda Loans Pennsylvania Usda Loan Info 8 464 8732

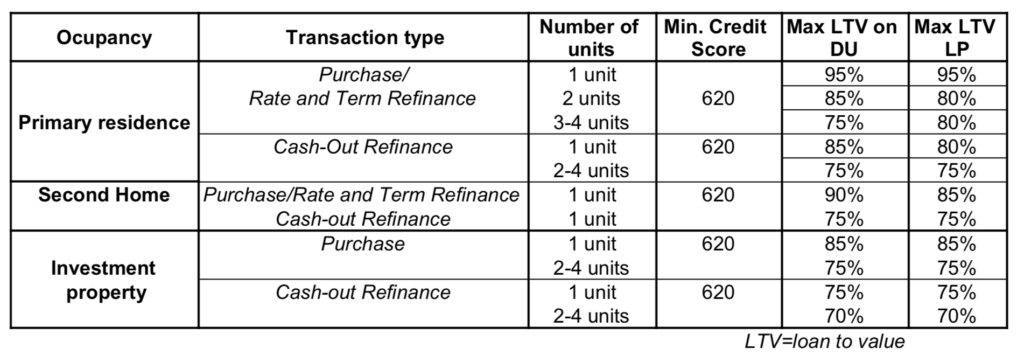

Interest rates and down payment requirements are higher when financing a rental home, but the conventional loan remains one of the few loan programs available to purchase rental propertiesUnlike government loan programs, conventional loans can be used to purchase a second home or a rental propertyConventional loans are also used to do jumbo loans — which are loans that exceed the statutory limits

Conventional Loan Requirements And Guidelines Credible

Conventional Loan

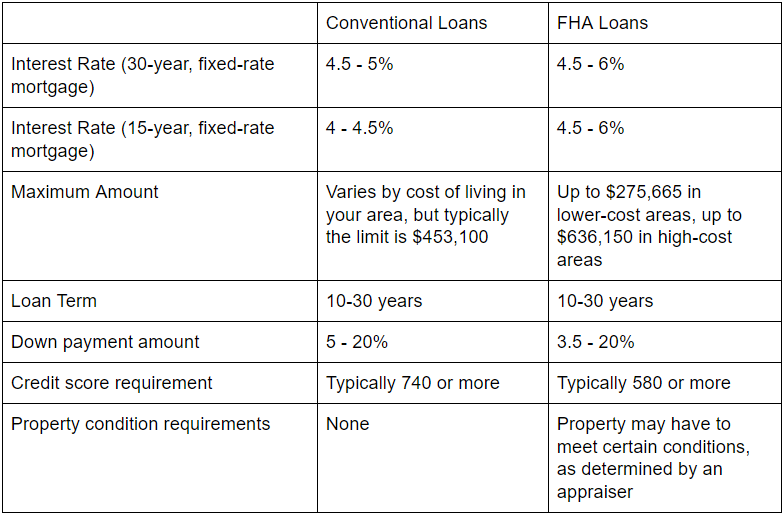

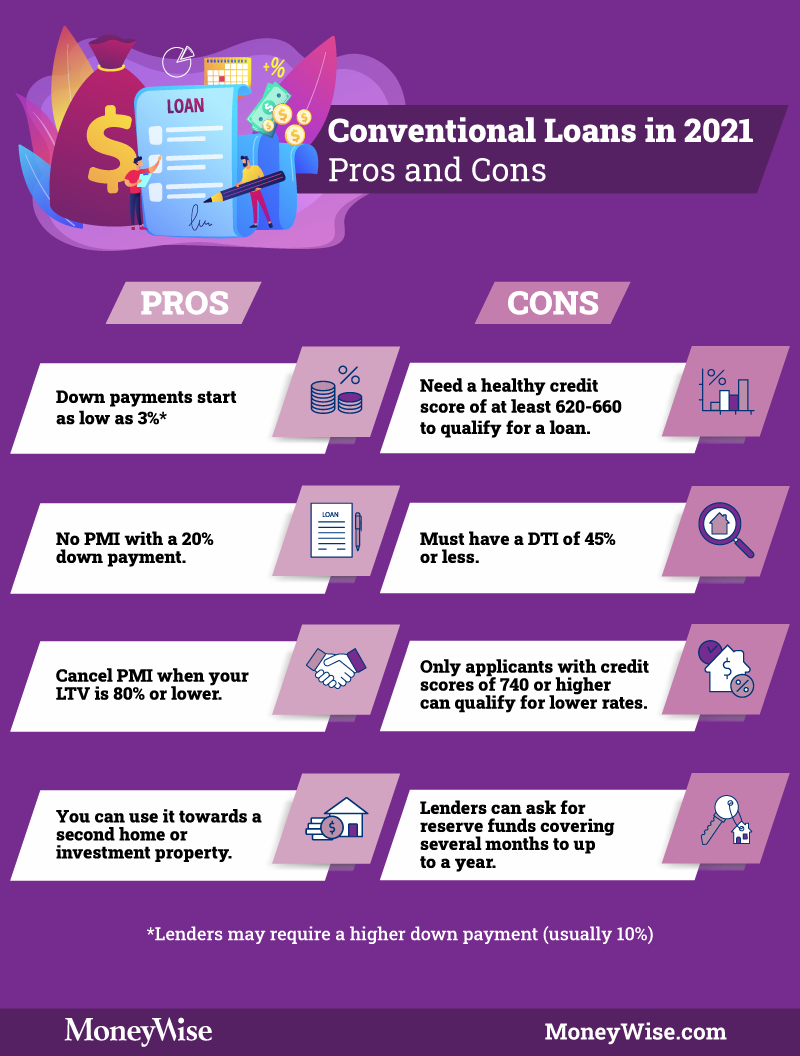

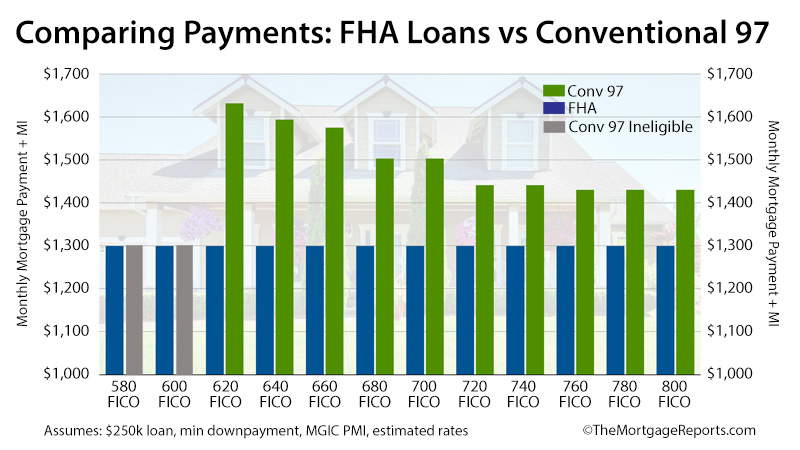

Conventional loans are the least restrictive of all loan types, in some respectsThe following examples will give you an idea of the differences in interest rates, monthly payments, mortgage insurance charges, and down payment requirements for different loan-to-value ratios and FICO scores

Advantages Of Conventional Mortgages Mortgage 1

What Is A Conventional Loan 21 Rates And Requirements

The Difference Between Fha Loan And Conventional Loan

How To Buy A House With 0 Down In 21 First Time Buyer

Credit Scores Needed For A Louisville Kentucky Fha Khc Va Usda And Conventional Mortgage Loan Louisville Kentucky Mortgage Loans Louisville Mortgage Loans For Fha Va Usda And Rural Housing With

Conventional Loan Purchase Murfreesboro Iserve Residential Lending

What S The Difference Between An Fha Loan And A Conventional Loan And Which One Is Best Major Business Center For Economy Solutions

Conventional Loan

How Is An Fha Loan Different From A Conventional Mortgage Mortgage Blog

Conventional Loans Mortgage Info

Fha Vs Conventional Mortgage Loans Eugene Oregon Amykleinmortgage Mortgage Payoff Tips Mortgage Payofftips Payo Mortgage Marketing Mortgage Tips Fha

Fha Loans Vs Conventional Loans Pros And Cons Updated 17

Fha Vs Conventional Loan Comparison Chart And Which Is Better

5 Types Of Mortgage Loans For Homebuyers Bankrate

Oh Mortgages Oh Mortgage Rates And Home Loans

Conventional Loan Guidelines For Mortgage Borrowers

What Is A Conventional Home Mortgage First Ohio Home Finance

Top 3 Differences Between Conventional Government Loans

Utah Conventional Mortgage Loan Utah Mortgage Resource

Understanding The Differences Between An Fha Loan And Conventional Loan Utah First Credit Union

Conforming Loan Limits Conventional Loan Limits

Fha Vs Conventional Loans What S The Difference Policygenius

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage What Is The Minimum Credit Score Needed To Buy A House And Get A Kentucky Mortgage Loan

Fha Vs Conventional Loan Down Payment Which Is Better

Fha Vs Conventional Down Payments It S A Tighter Race These Days Fhahandbook Com

Conventional Loans And Down Payments

What Is A Conventional Mortgage Loan Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Is A Conventional Loan Thestreet

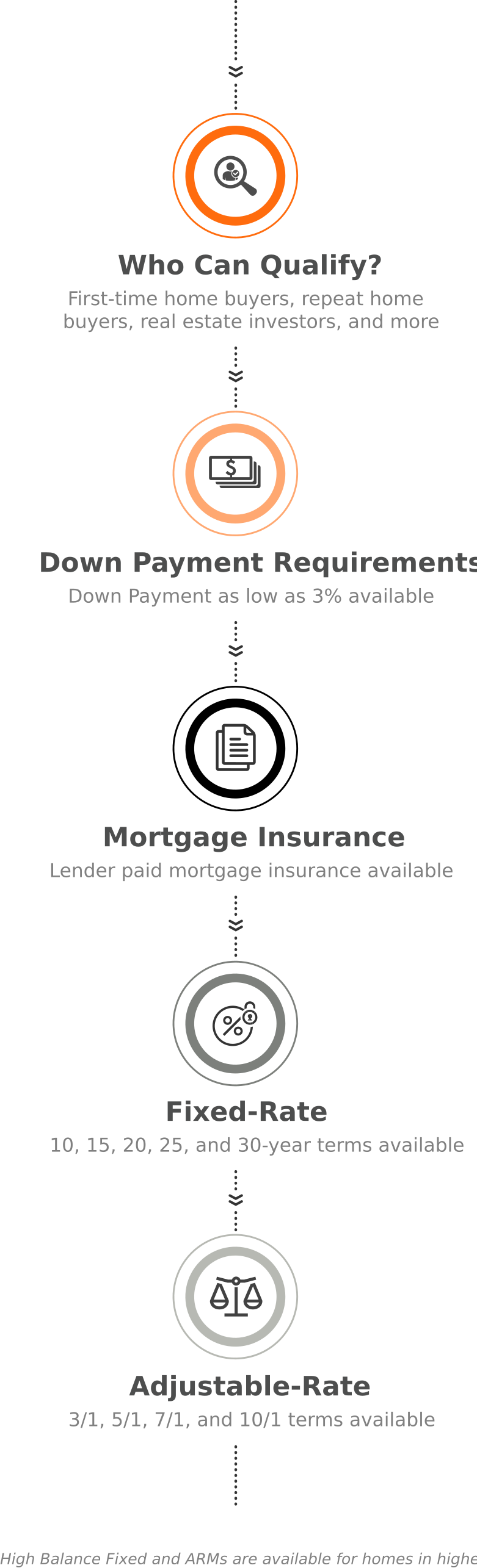

Conventional Loans Chris Jordan Mortgage Team

Conventional Loans Superior Mortgage Lending Llc

How Is An Fha Loan Different From A Conventional Mortgage Mortgage Blog

What Is An Fha Loan And How Does It Differ From A Conventional Loan Quora

/what-is-a-conventional-loan-1798441_FINAL-cd12be4836c94eb6ae68117635d2dc19.png)

Types Of Conventional Loans For Homebuyers

Conventional Loan Limits For 19 Remn Wholesale A Division Of Homebridge Financial Services

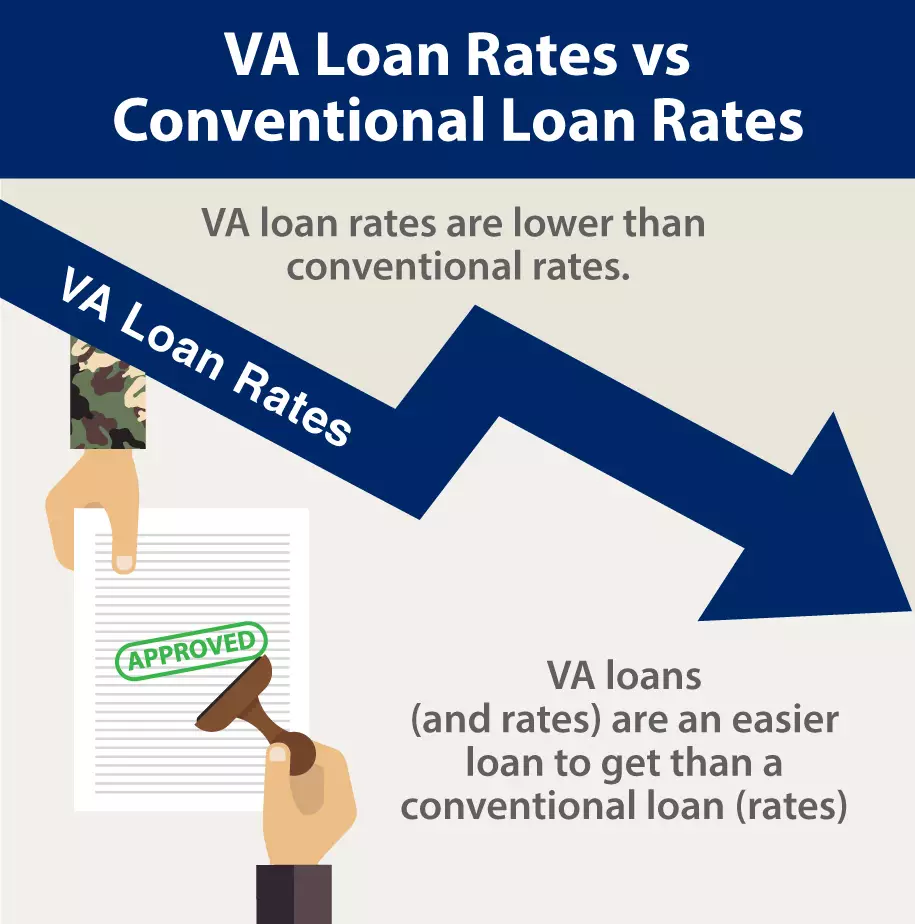

Conventional Mortgage Vs Va Loan Self

Fha Vs Conventional Loan Is There A Difference

What Is A Conventional Loan Youtube

Low Down Payment And First Time Home Buyer Programs 19 Edition

Fha Vs Conventional Choosing Which Loan Is Best For You

Conventional Mortgage Versus Va Loan A Comparison With Infographic Patriot Home Mortgage

Conventional Refinance Loan Requirements

Delaware Conventional Loan Limits Prmi Delaware

Conventional Mortgage Loans Cmg Financial

Conventional Loan Limit Increase Gmfs Mortgage

New Conventional Loan Refinance Fee Coming Soon Modern Lending Team

Jumbo Vs Conventional Loan Ally

Fhfa Announces Increase To Maximum Conventional Loan Limits 18 Prmi Delaware

Q Tbn And9gct07p7frn0yntamgmpuknm1qez L2kbwv9ui3sy Iddvkihh V Usqp Cau

Conventional Vs Fha Homesmsp

1

Conventional Mortgage Rates Up To 726 525 Jumbo Loan Programs

Va Home Loan Rates Vs Conventional Interest Rates So Cal Va Homes

Texas Conventional Loan Requirements For 21 Supreme Lending Team Pierson

Conventional Loan Limits Have Increased Gmfs Mortgage

What Is A Conventional Mortgage Loan The Truth About Mortgage

Conventional Loan Requirements Rates For 21

Conventional Loan Requirements Rates For 21

Fha Vs Conventional Loan Which Mortgage Is Right For You Realtor Com

Fha Vs Conventional Loans How To Choose Updated For 18 Total Mortgage Blog

Conventional Loan Limits For 19 Announced

Fha Or Conventional Loan Our First Home Com

Conventional Loan Down Payment Assistance Grants With No Repayment

Conventional Loan Vs Fha Loan Guide For Buyers And Sellers

Fha Loan Vs Conventional Loan Key Differences New American Funding

Fha Vs Conventional Loans Pros Cons To Both

Fha Vs Conventional Loans Which Is Better

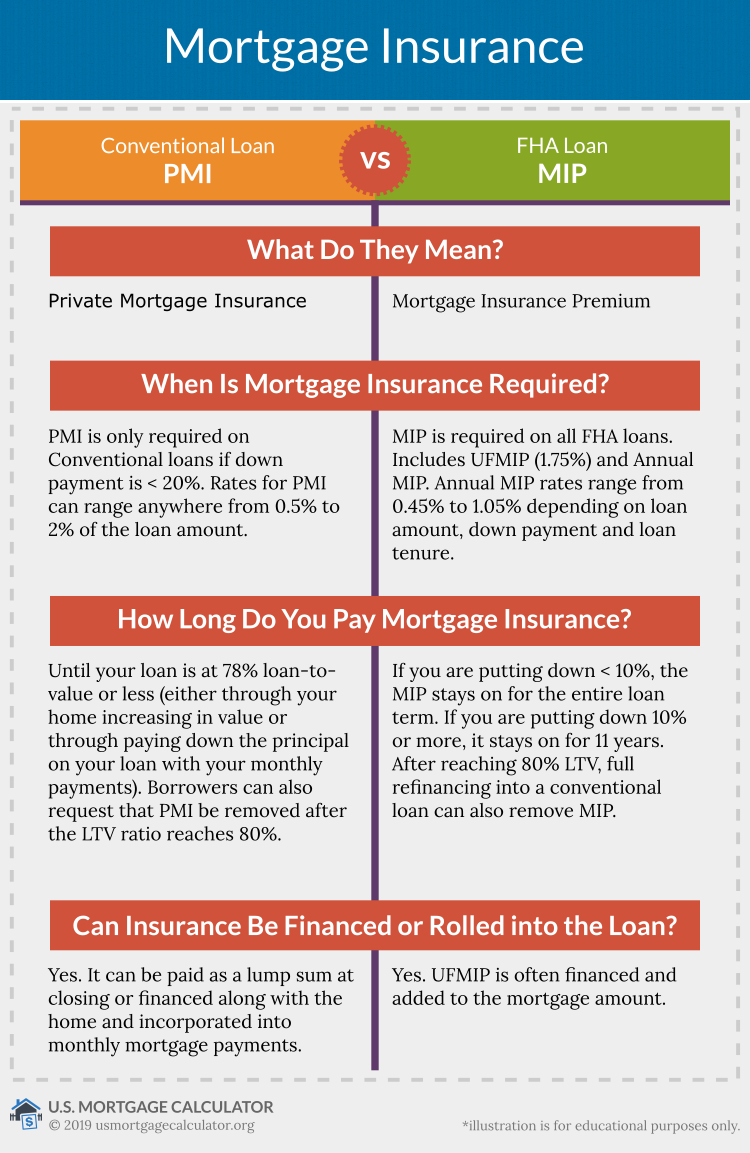

Private Mortgage Insurance Pmi Faq U S Mortgage Calculator

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 18 Fha V Fha Loans Conventional Loan Mortgage Loans

Conventional Loan Dayton Home Loans Mortgage Rates

Conventional Loan Limits For Remn Wholesale A Division Of Homebridge Financial Services

Conventional Mortgage Calculator What Is A Conventional Home Loan Prequalify Calculate Your Monthly Payments Today

Conventional Loans In Florida Residential Or Commercial 18

Conventional Loan Limits For 21 Remn Wholesale A Division Of Homebridge Financial Services

Conventional Home Loans Arizona The Az Mortgage Brothers

When Is A 5 Down Conventional Loan Better Than Fha

Conventional Loan Requirements And Guidelines Credible

Fha Loan Vs Conventional Loan Key Differences New American Funding

Different Types Of Mortgage Loans

Va Loans Vs Conventional Loans A Complete Comparison

Fha Vs Conventional Loan The Pros And Cons The Truth About Mortgage

Fha Vs Conventional Loan The Pros And Cons The Truth About Mortgage

Switching From An Fha To A Conventional Loan New American Funding

Conventional Loan Requirements

Is A Conforming Loan The Same As Conventional

Conventional Home Loans Rates Eligibility Benefits Pennymac

Which Is Better Fha Or Conventional Loan

Q Tbn And9gct07p7frn0yntamgmpuknm1qez L2kbwv9ui3sy Iddvkihh V Usqp Cau

Conventional Loan Limits For Hawaii Hawaii Real Estate Market Trends Hawaii Life

Low Down Payment And First Time Home Buyer Programs 19 Edition

What Is A Conventional Loan Everything You Need To Know

Conventional Loans Us Home Loan News

19 Conventional Loan Limits Homebridge Wholesale

Xg 06s4 08wwfm

Fha Vs Conventional Loan Down Payment Which Is Better

コメント

コメントを投稿